What You Need To Know About Pre-Approval

Some Highlights

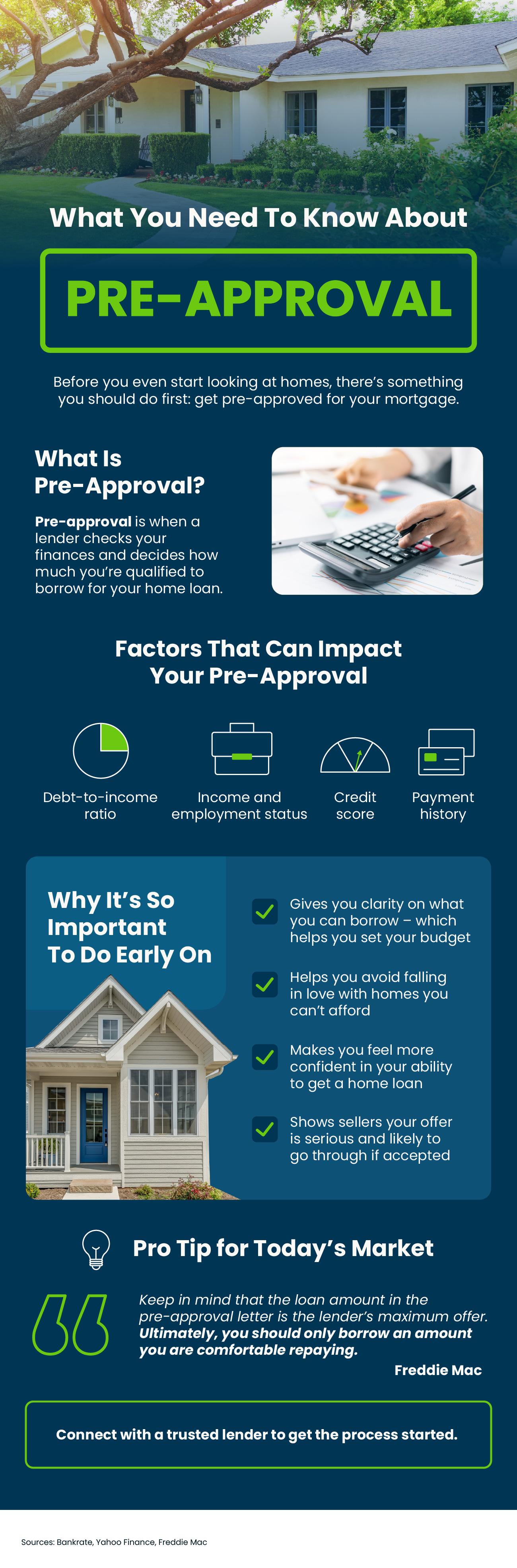

- Before you even start looking at homes, there’s something you should do first – and that’s get pre-approved for your mortgage.

- Pre-approval is when a lender checks your finances and decides how much you’re qualified to borrow for your home loan. This helps you determine your budget and makes your offer stand out for sellers.

- Connect with a trusted lender to get the process started.

Categories

Recent Posts

More Buyers Are Planning To Move in 2026. Here’s How To Get Ready.

Not Sure If You’re Ready To Buy a Home? Ask Yourself These 5 Questions.

Reasons To Be Optimistic About the 2026 Housing Market

Turning a House Into a Home: The Benefits You Can Actually Feel

Your House Didn’t Sell. What Now?

Headlines Have You Worried about Your Home’s Value? Read This.

Is January the Best Time To Buy a Home?

Is Buyer Demand Picking Back Up? What Sellers Should Know.

How To Stretch Your Options, Not Your Budget

Your Equity Could Change Everything About Your Next Move